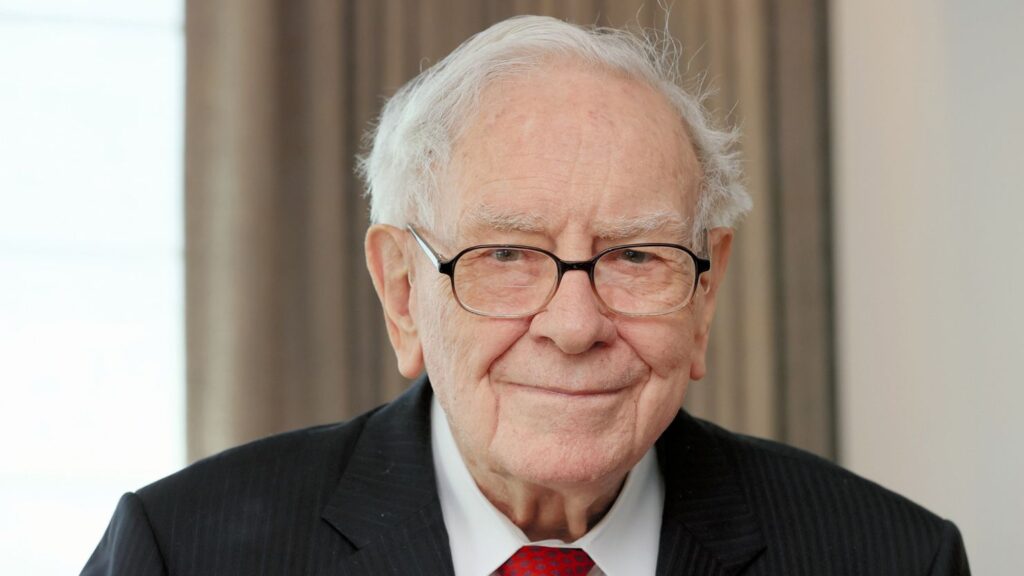

Warren Buffett, the legendary investor known as the “Oracle of Omaha,” has been a guiding light for generations of investors with his unique, long-term approach to value investing. His portfolio, managed through Berkshire Hathaway, is filled with carefully chosen stocks that reflect his commitment to buying businesses at a fair price and holding them for the long run. In this comprehensive article, we will delve deep into the world of Warren Buffett stocks, exploring his investment strategy, examining his top picks, and understanding how his decisions affect the broader market. Whether you’re an aspiring investor or a seasoned market participant, there is much to learn from Buffett’s disciplined approach to investing.

The Philosophy Behind Buffett’s Investment Strategy

Warren Buffett’s investment philosophy is rooted in the principles of value investing, a strategy he adopted from his mentor Benjamin Graham. At its core, value investing is about finding undervalued companies whose stocks are selling for less than their intrinsic value. Buffett believes that by purchasing shares of high-quality businesses at attractive prices, investors can achieve superior long-term returns. “It’s far better to buy a wonderful company at a fair price than a fair company at a wonderful price,” he famously said.

Buffett’s approach emphasizes several key tenets: understanding the business, focusing on the long term, and investing with a margin of safety. He meticulously studies the companies he invests in, paying close attention to financial statements, competitive advantages, management quality, and market conditions. Unlike many investors who chase short-term trends, Buffett is famous for his patience, often holding onto his investments for decades. This long-term outlook has not only allowed him to ride out market volatility but also to benefit from the compounding growth of his investments.

Buffett’s Notable Stock Picks

Over the years, Buffett has built a diversified portfolio that includes some of the most well-known and successful companies in the world. Among his top holdings are giants like Apple, Bank of America, Coca-Cola, and American Express. Each of these stocks reflects a facet of his investment philosophy and has contributed to the impressive performance of Berkshire Hathaway’s portfolio.

Apple (AAPL):

Perhaps the most prominent of Buffett’s recent investments is Apple. Despite initially being skeptical about technology stocks, Buffett recognized Apple’s potential as a consumer products company with a powerful ecosystem and strong brand loyalty. Today, Apple remains one of the cornerstone holdings of Berkshire Hathaway, representing a significant portion of its equity portfolio. Buffett’s decision to invest heavily in Apple underscores his belief that great businesses can continue to thrive even in competitive and rapidly changing markets.

Bank of America (BAC):

Bank of America has been another major investment for Buffett. Acquired during a period of economic uncertainty, BAC represents Buffett’s confidence in the resilience of the financial sector. Over time, his stake in Bank of America has not only recovered but also grown, highlighting his ability to capitalize on market dislocations and turn them into profitable opportunities. Although Buffett has trimmed his position in recent quarters, Bank of America remains a key component of Berkshire’s diverse portfolio.

Coca-Cola (KO):

Buffett’s investment in Coca-Cola is legendary. Having first invested in the company in the late 1980s, he has famously described Coca-Cola as one of his “forever stocks.” The beverage giant’s enduring brand strength and consistent dividends make it a classic example of a company with a durable competitive advantage. For Buffett, Coca-Cola represents the epitome of a business that generates reliable cash flow, a critical factor in his investment decision-making process.

American Express (AXP):

American Express is another long-term favorite of Buffett. Known for its strong market position and customer loyalty, American Express has been a key holding in Berkshire Hathaway’s portfolio for decades. Buffett’s unwavering support for AXP, even in the face of occasional market challenges, speaks to his belief in the company’s robust business model and long-term growth prospects.

The Role of Cash and Liquidity in Buffett’s Portfolio

One of the most intriguing aspects of Warren Buffett’s investment strategy is his management of cash and liquidity. Despite the seemingly massive cash reserves that Berkshire Hathaway holds, Buffett remains committed to deploying a substantial majority of that cash into equities. In his annual letters to shareholders, he has often emphasized that holding cash is merely a temporary position until the right investment opportunity arises.

Berkshire Hathaway’s record cash pile, often exceeding hundreds of billions of dollars, is a result of disciplined stock sales and cautious market timing. Buffett is known for selling stocks when he believes their prices have become too inflated, only to reinvest the proceeds in undervalued companies later. This approach not only ensures that Berkshire Hathaway is prepared to capitalize on market downturns but also serves as a hedge against economic uncertainty.

How Buffett Decides When to Buy or Sell

The decision-making process behind Buffett’s stock transactions is a subject of much interest for investors worldwide. Buffett has often stated that he is not swayed by short-term market trends or daily stock price fluctuations. Instead, he focuses on the intrinsic value of the companies he invests in and the long-term prospects of those businesses.

Buying Opportunities:

Buffett is known for his opportunistic buying strategy. When market conditions are unfavorable and stock prices drop significantly, Buffett sees it as an opportunity to purchase shares of high-quality companies at bargain prices. His famous advice, “Be fearful when others are greedy and greedy when others are fearful,” encapsulates this approach. During periods of market volatility, Buffett’s patience often pays off as he accumulates stocks at attractive valuations, positioning Berkshire Hathaway for substantial long-term gains.

Selling Decisions:

While Buffett is a long-term investor, he is not averse to selling when the market conditions warrant it. He has trimmed positions in certain stocks, such as Bank of America and Apple, when he believes that their valuations have reached levels that are no longer attractive. However, such sales are generally strategic and designed to free up capital for future investments rather than a sign of bearish sentiment. Buffett’s selling decisions are typically driven by a combination of factors, including changes in the underlying business fundamentals, overvaluation, or the emergence of better investment opportunities.

The Impact of Buffett’s Moves on the Market

Warren Buffett’s stock picks are closely watched by both institutional and retail investors. His decisions to buy, hold, or sell stocks can have a significant impact on market sentiment and the performance of individual companies. When Buffett makes a move, it is often seen as a vote of confidence in the business and its long-term prospects.

For example, when Buffett announced increased investments in Apple, it bolstered investor confidence in the tech giant, leading to a surge in its stock price. Conversely, when he trimmed positions in certain banks, it signaled caution and often led to a temporary dip in their stock valuations. Buffett’s portfolio moves are widely reported and analyzed, and his annual letters to shareholders are considered essential reading for anyone interested in understanding the nuances of value investing.

Buffett’s Influence on Individual Investors

Warren Buffett’s investment philosophy has influenced millions of investors around the globe. His focus on long-term value, disciplined investment decisions, and the importance of understanding a business have become guiding principles for individual investors looking to build wealth over time.

Buffett’s annual shareholder letters, in which he shares insights on his investment approach and reflects on market trends, are particularly popular among retail investors. These letters not only provide a window into his thinking but also offer practical advice that can be applied by investors at all levels of experience.

Many individual investors take Buffett’s advice to heart by focusing on the fundamentals of the businesses they invest in, avoiding the temptations of short-term market fluctuations, and maintaining a patient, disciplined approach to investing. By emulating Buffett’s strategies, many have managed to achieve impressive long-term returns, proving that the principles of value investing can be effectively applied even by those without vast financial resources.

Case Studies: Buffett’s Successful Investments

To illustrate the effectiveness of Buffett’s investment strategy, it is helpful to look at a few case studies of some of his most successful investments.

Apple: A Case Study in Brand Loyalty and Innovation

Apple is perhaps the most celebrated stock in Buffett’s portfolio. Despite his initial skepticism about technology companies, Buffett recognized that Apple was more than just a tech company—it was a consumer products powerhouse with a loyal customer base. The ecosystem that Apple has built around its products, from the iPhone to the Mac and beyond, creates a competitive advantage that is hard to replicate.

Over the years, Apple’s stock price has grown exponentially, rewarding Buffett’s long-term investment approach. Even though he has periodically sold portions of his Apple stake, Buffett has consistently maintained a significant position in the company, underscoring his belief in its enduring value.

Coca-Cola: The Eternal Beverage Giant

Coca-Cola is another classic example of Buffett’s investment acumen. When Buffett first invested in Coca-Cola in the late 1980s, the company was already an iconic brand with a proven track record of delivering consistent earnings and dividends. Coca-Cola’s business model, based on global brand recognition and strong distribution channels, provided a stable and reliable source of cash flow.

Buffett’s investment in Coca-Cola has proven to be a masterstroke, as the company’s share price and dividend payments have consistently appreciated over time. This long-term holding has not only generated substantial returns but has also served as a model for other investors looking to identify enduring companies with competitive moats.

American Express: A Financial Powerhouse

American Express has long been one of Buffett’s favorite investments. The company’s ability to build a strong brand, coupled with its robust network of merchants and cardholders, has allowed it to generate significant profits over the years. Buffett’s investment in American Express reflects his confidence in the company’s business model and its ability to deliver sustainable growth.

Despite facing challenges such as regulatory scrutiny and competitive pressures, American Express has continued to perform well, reinforcing Buffett’s strategy of holding onto quality stocks for the long term. This case study serves as a testament to the importance of investing in companies with durable competitive advantages.

The Future of Buffett’s Investment Strategy

As the market continues to evolve, so too does Warren Buffett’s approach to investing. While his core principles remain unchanged, the changing economic landscape, technological advancements, and evolving consumer preferences require continuous adaptation. Buffett’s recent moves—such as increasing stakes in Japanese trading companies and carefully managing Berkshire Hathaway’s significant cash reserves—indicate that he remains vigilant and responsive to market conditions.

Looking ahead, there are several trends and challenges that Buffett is likely to consider in his investment strategy:

- Market Valuations: With stock prices at record highs in many sectors, Buffett’s cautious approach may continue to see Berkshire Hathaway holding onto its cash reserves until more attractive opportunities emerge.

- Global Investments: As domestic opportunities become scarcer, Buffett may increasingly look to international markets for investments, particularly in regions where economic conditions are favorable and valuations are lower.

- Technological Disruption: While Buffett has historically been wary of technology stocks, the rapid pace of innovation may prompt him to reconsider his stance on certain tech companies—especially those that align with his criteria of strong management and sustainable competitive advantages.

- Environmental and Social Governance: With growing awareness of ESG factors, Buffett’s investment decisions may also increasingly factor in a company’s social and environmental impact, ensuring that his portfolio remains resilient in a changing world.

- Succession Planning: As Buffett nears the twilight of his career, the transition of leadership at Berkshire Hathaway will be closely watched by investors. His careful grooming of successors like Greg Abel ensures that his investment philosophy and long-term vision will continue to guide the conglomerate even after he steps aside.

Lessons for Investors from Buffett’s Approach

Warren Buffett’s investment style offers several valuable lessons for individual investors:

- Focus on Quality: Invest in companies with strong fundamentals, durable competitive advantages, and capable management. Quality investments tend to deliver consistent returns over time.

- Patience Pays Off: Buffett’s long-term perspective teaches investors to be patient and not get caught up in short-term market volatility. By holding onto quality stocks, investors can benefit from the power of compounding returns.

- Be Opportunistic: Market downturns can present excellent buying opportunities for those who are prepared. Buffett’s strategy of buying when others are fearful has enabled him to acquire high-quality stocks at bargain prices.

- Maintain a Margin of Safety: Always invest with a margin of safety. This principle, derived from Benjamin Graham’s teachings, involves purchasing stocks at a price that is significantly below their intrinsic value, thereby reducing risk.

- Keep It Simple: Buffett’s approach is based on simple, understandable principles. Avoid overly complex investments that you do not fully understand.

- Learn from Mistakes: Even Buffett has made investment mistakes, such as his foray into technology during the dot-com bubble. The key is to learn from these errors and adjust your strategy accordingly.

- Stay Informed: Buffett is known for his voracious reading and continuous learning. Keeping up with financial news, studying company reports, and understanding market trends are essential for making informed investment decisions.

Frequently Asked Questions About Warren Buffett Stocks

Q: What are Warren Buffett’s top holdings?

A: As of the latest filings, Warren Buffett’s top holdings include Apple, American Express, Bank of America, Coca-Cola, and Chevron. These stocks represent a significant portion of Berkshire Hathaway’s equity portfolio and reflect his focus on high-quality, enduring businesses.

Q: Why does Warren Buffett hold a large cash reserve?

A: Buffett maintains a substantial cash reserve to ensure that Berkshire Hathaway is prepared to capitalize on attractive investment opportunities when the market presents them. Although the cash pile may seem large, Buffett has repeatedly stated that the majority of shareholder money remains invested in equities.

Q: How does Warren Buffett decide when to buy or sell stocks?

A: Buffett bases his decisions on the intrinsic value of a company, its competitive advantages, management quality, and market conditions. He buys stocks when they are undervalued and sells when their prices no longer offer a margin of safety or when better opportunities arise.

Q: What is value investing?

A: Value investing is a strategy that involves buying stocks at prices that are lower than their intrinsic value. It is based on the idea that the market sometimes undervalues good businesses, creating opportunities for investors to purchase shares at a discount.

Q: How has Buffett’s portfolio performed over the long term?

A: Over the decades, Berkshire Hathaway’s portfolio has delivered impressive returns, with a compound annual growth rate that significantly outperforms major indices like the S&P 500. Buffett’s disciplined approach to investing has helped him achieve substantial long-term gains.

Q: Can individual investors mimic Buffett’s strategy?

A: While individual investors may not have the same resources as Buffett, they can apply similar principles by focusing on high-quality companies, investing for the long term, and maintaining a margin of safety. Patience and discipline are key components of successful investing.

Conclusion: The Enduring Legacy of Warren Buffett’s Investment Genius

Warren Buffett’s stock picks and investment strategies have earned him a reputation as one of the most successful investors of all time. Through Berkshire Hathaway, he has built a diversified portfolio that not only generates impressive returns but also serves as a model for investors around the world. His commitment to understanding businesses, investing with a margin of safety, and maintaining a long-term perspective continues to inspire countless individuals seeking to build wealth.

As we look to the future, Buffett’s approach to investing offers enduring lessons on the importance of quality, patience, and disciplined decision-making. While market conditions may change and new investment opportunities may emerge, the fundamental principles that have guided Buffett’s success remain as relevant as ever. For individual investors, the key takeaway is simple: by focusing on what truly matters—the intrinsic value of a business—and by remaining patient, it is possible to achieve lasting financial success.

In a world where short-term trends often dominate headlines, Warren Buffett’s steadfast adherence to timeless investing principles serves as a beacon of stability and wisdom. His ability to navigate market cycles, seize opportunities during downturns, and maintain a focus on long-term value is a testament to the power of disciplined investing. Whether you are a novice investor or a seasoned market participant, embracing Buffett’s approach can provide the foundation for building a robust and resilient investment portfolio.

Warren Buffett’s legacy as a master investor is not just measured by the billions of dollars he has amassed or the size of his portfolio, but by the principles and strategies that have revolutionized the world of investing. His story is a powerful reminder that with the right approach, perseverance, and a focus on quality, anyone can achieve extraordinary success in the stock market.

As we conclude this deep dive into Warren Buffett’s stock strategy, let his investment philosophy guide your own journey toward financial independence and long-term wealth creation. The path may not always be easy, but the rewards of a disciplined, thoughtful approach to investing can be truly transformative.